XRP Price Prediction: Analyzing the Bull Case Amidst Market Volatility

#XRP

- Consolidation at a Technical Crossroads: XRP's price is balanced between key support and resistance levels, with its next major move likely dictated by a break above $2.13 or below $1.95.

- Powerful Fundamentals vs. Near-Term Volatility: Strong long-term drivers like regulatory licensing and ETF potential are contrasted by immediate concerns over whale-driven sell-offs and market indecision.

- A High-Stakes Asymmetric Bet: The investment case hinges on a belief in Ripple's institutional success, offering significant upside (e.g., $23 targets) but carrying substantial risk of a sharp correction in the short term.

XRP Price Prediction

Technical Analysis: XRP at Critical Juncture

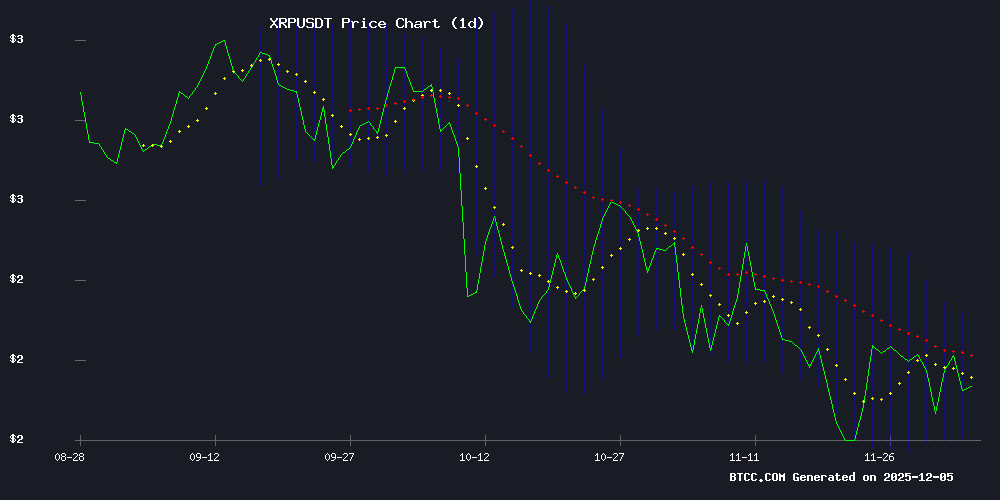

According to BTCC financial analyst James, XRP is currently trading at $2.1059, slightly below its 20-day moving average of $2.1314. This positioning suggests a moment of equilibrium. The MACD indicator shows a bearish crossover with a value of -0.0161, indicating potential short-term selling pressure. However, the price remains comfortably above the lower Bollinger Band at $1.9540, which acts as a key support level. The middle band at $2.1314 and the upper band at $2.3087 define the immediate trading range. A sustained break above the 20-day MA could signal a shift towards testing the $2.30 resistance.

Market Sentiment: A Mix of Euphoria and Caution

BTCC financial analyst James notes that current news headlines paint a complex picture for XRP. Bullish catalysts like Ripple's Singapore license expansion, record on-chain activity, and ongoing ETF speculation are fueling Optimism for significant price appreciation, with some technical analyses even projecting targets as high as $23. However, this is tempered by clear signs of caution. News of whale sell-offs creating volatility, a split among traders on the near-term direction, and the fact that only 4% of holders own a substantial amount of XRP highlight underlying market fragility. The sentiment is decidedly mixed, aligning with the technical view that XRP is at a crossroads between a major breakout and a corrective pullback.

Factors Influencing XRP’s Price

Technical Analysis Suggests XRP Could Reach $23 Amid Bullish Momentum

Ripple's XRP, renowned for its cross-border payment solutions, is capturing market attention as ETF developments fuel speculation about its price potential. Analysts project dramatic highs, with some targets reaching $20-$100, but technical charts suggest a more measured trajectory.

Egrag Crypto's analysis indicates XRP is forming a bull pennant pattern, with historical cycles pointing to a potential $23 peak. The token's price action since 2013 shows consistent bullish cycles, with the current momentum mirroring previous breakout formations.

Market observers note XRP's unique position as both a payment rail and speculative asset. While retail enthusiasm drives short-term volatility, institutional adoption through ETFs could provide the liquidity needed to sustain higher valuations.

Ripple Secures Singapore License as GeeFi Captures Investor Attention

Ripple's licensing milestone in Singapore underscores its growing influence in institutional blockchain solutions, particularly for cross-border payments. Yet investor enthusiasm is pivoting toward GeeFi, a new decentralized finance platform whose presale phases are selling out with unprecedented speed.

The contrast highlights a market bifurcation: established players like Ripple dominate enterprise corridors while agile newcomers target retail adoption. GeeFi's all-in-one platform—featuring a non-custodial wallet, DEX, and upcoming crypto debit cards—has seen its Phase 2 presale tokens sell out in under five days, suggesting grassroots demand for integrated solutions.

Analysts note the parallel trajectories: Ripple's regulatory progress validates the sector, while GeeFi's rapid uptake demonstrates retail investors' appetite for turnkey crypto tools. The latter's Android-compatible wallet (with iOS pending) provides immediate utility—a key differentiator in a crowded DeFi landscape.

Expert Outlines Conditions for XRP Supply Shock Amid ETF Speculation

Market analyst Pumpius challenges prevailing misconceptions about XRP supply dynamics, arguing that true scarcity hinges on measurable token absorption—not speculation. The catalyst? Institutional demand via ETFs. "A supply shock requires irreversible removal of tokens from circulation," he asserts, noting that derivative-based trading merely postpones the reckoning.

ETF approvals could trigger the first phase of sustained buying pressure, as issuers transition from synthetic products to physical XRP holdings. This structural shift WOULD compound if traditional finance entities enter the market, creating a feedback loop of dwindling exchange reserves and accelerating price discovery.

Only 4% of XRP Holders Cross the 10K Threshold Amid Rising Prices

Holding 10,000 XRP has become a critical benchmark in crypto investing, with just 4% of wallets reaching this level. At current prices of $2.20 per token, the $22,000 investment required sparks debate over what constitutes a viable entry point for retail participants.

Data reveals only 294,301 out of 7.357 million active wallets hold at least 10,308 XRP. Over 6 million contain 500 tokens or fewer, with 3.46 million holding negligible amounts between 0-20 XRP. "Anything over 10,000 XRP and you are doing fine," asserts prominent commentator TheXRPguy, framing the threshold as a new success metric.

Edoardo Farina of Alpha Lions Academy notes rising prices have effectively priced out accumulation strategies for most retail investors. The 10K benchmark emerges as both a psychological and financial barrier in XRP's evolving market structure.

XRP Whale Sell-Off Triggers Market Volatility as Investors Shift to Cloud Mining

XRP prices have slumped following aggressive sell-offs by large holders, sparking short-term panic in the market. On-chain data reveals whales accelerating transfers and liquidations, forcing retail investors to reconsider their holding strategies.

Amid the turbulence, LeanHash's cloud mining platform is gaining traction as an alternative for risk-averse participants. The service promises stable daily returns, contrasting sharply with XRP's current volatility. Entry-level contracts advertise 7% returns over 48 hours, appealing to those seeking predictable yields.

XRP at Crossroads: Traders Split Between $3 Breakout or $1.20 Correction

XRP faces a pivotal moment as traders debate its next major price movement. The token must hold the $2 support level to avoid a potential drop to $1.20, according to analyst Ali Charts. Market volatility remains high, with Bitcoin's consolidation NEAR cycle highs and capital rotation into high-beta altcoins adding uncertainty.

Meanwhile, AI-focused tokens like SUBBD are emerging as a distinct sector, targeting the creator economy. These projects aim to address Web2 platform pain points, such as excessive revenue cuts and arbitrary account bans, by offering censorship-resistant alternatives with integrated Web3 payments and AI tools.

XRP On-Chain Activity Hits Yearly High Amid Whale Accumulation and Staking Launch

XRP's on-chain velocity surged to a record annual peak on December 2, signaling a potential uptick in economic activity. The spike follows a period of retail apathy, now countered by whale re-accumulation and the debut of a liquid staking platform for XRP tokens.

Network data reveals coins changing hands at an accelerated pace, coinciding with Ripple's recent payment service license approval in Singapore. The metric suggests either large-scale wallet movements or liquidity positioning ahead of anticipated trading volatility.

Despite trading in a tight range near $2.17, XRP demonstrates resilience by rebounding above key psychological levels. The 2025 market saw persistent whale selling pressure absorbed by retail investors awaiting a decisive breakout.

Ripple's XRP Enters Pivotal Week Amid ETF Expansion and Supply Squeeze

XRP stands at an inflection point as institutional demand converges with tightening supply. Five major asset managers—21Shares, Bitwise, Grayscale, Franklin Templeton, and Canary Capital—now compete in the US spot ETF arena, marking a watershed moment for the token's institutional footprint. Aggregate inflows have exceeded $824 million within weeks, with zero net outflows recorded since launch.

Exchange reserves are thinning just as ETF buying accelerates. Analysts note this supply-demand imbalance could structurally redefine XRP's market dynamics. Ripple's growing institutional partnerships further fuel speculation that this week may catalyze a sustained bullish phase.

Is XRP a good investment?

Based on the current technical data and market news, XRP presents a high-risk, high-reward investment proposition at this juncture. The technical setup shows the asset in a consolidation phase, with key levels to watch. A break above $2.13 could open the path toward $2.30, while a drop below $1.95 would signal deeper correction risks.

The fundamental news is a tale of two narratives. On one hand, institutional progress with Ripple and ETF speculation provide a strong long-term bull case. On the other, whale activity and trader indecision suggest near-term volatility is likely.

| Factor | Bullish Signal | Bearish Signal |

|---|---|---|

| Price & Technicals | Holding above key support ($1.95). | Trading below 20-day MA; negative MACD. |

| Adoption & Regulation | Ripple's Singapore license; ETF speculation. | Regulatory overhang for the broader asset class. |

| Market Behavior | High on-chain activity; whale accumulation. | Whale sell-offs; low % of large holders. |

| Price Targets | Long-term projections up to $23 in bullish scenarios. | Near-term risk of correction to $1.20. |

Therefore, XRP could be a good investment for investors with a high risk tolerance, a long-term horizon, and the conviction that Ripple's institutional adoption will ultimately drive value. It is less suitable for conservative investors seeking stability, as the path will likely be volatile. Diversification and clear risk management are essential.